Se trovate questo post interessante, siete invitati a condividerlo con i tasti "social" (Facebook, Twitter etc) che trovate subito dopo la fine del testo.

Aggiornamento delle 13.35

Vedi anche il post fresco fresco di Icebergfinanza: SHOCK OIL: RECESSIONE ASSICURATA!

-------------------------------------

Quando durante la cosiddetta primavera Araba (aprile-maggio 2011) il Petrolio schizzò a 115 Dollari (Wti)

tutti iniziarono a preoccuparsi parlando d'inflazione, di serie minacce alla ripresa etc etc

Adesso che il Petrolio Wti ha sfondato i 105$ al barile ed il brent i 120$...

tra Crisi Iraniana, speranze di accelerazione della Ripresa USA, nuova tornata di Quantitative Easing Europeo (LTRO), UK, Cinese e Giapponese (segui i link per scoprire le varie misure adottate) e speranze per una "soluzione" (leggi "tamponamento") della Crisi dell'Eurozona

beh...tutti naturalmente se ne sbattono altamente los cocones: infatti siamo in modalità uber-bullish che anestetizza qualunque rischio.

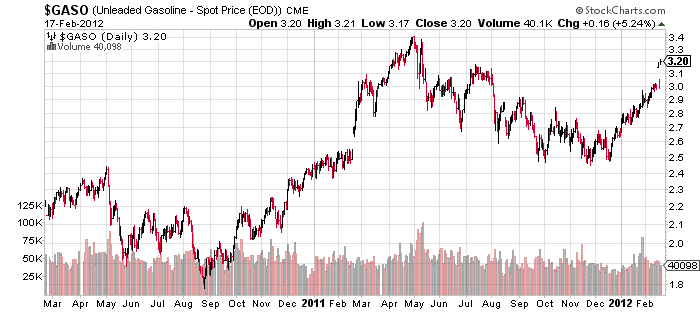

Eppure negli ultimi 4 mesi è mezzo la progressione al rialzo del petrolio è veramente impressionante (da 75$ a 105$) come potete vedere dal grafico sopra riportato................

E naturalmente anche il prezzo della Benzina continua a salire.

In USA il Gas Price ha toccato i massimi livelli di sempre per questo periodo dell'anno:

l'umento dei prezzi della benzina ha sempre influenzato in modo sensibile la fiducia dei consumatori americani, i consumi stessi e dunque la Ripresa made in USA (basata in modo decisivo sui consumi interni).

GAS PRICES HIT HIGHEST LEVEL EVER FOR THIS TIME OF YEAR….

“At $3.53 a gallon, prices are already up 25 cents since Jan. 1. And experts say they could reach a record $4.25 a gallon by late April.

“You’re going to see a lot more staycations this year,” says Michael Lynch, president of Strategic Energy & Economic Research. “When the price gets anywhere near $4, you really see people react.”

…Higher gas prices could hurt consumer spending and curtail the recent improvement in the U.S. economy.

A 25-cent jump in gasoline prices, if sustained over a year, would cost the economy about $35 billion.

That’s only 0.2 percent of the total U.S. economy, but economists say it’s a meaningful amount, especially at a time when growth is only so-so. The economy grew 2.8 percent in the fourth quarter, a rate considered modest following a recession.”

vi rimando alle mie Formulette Petrolifere (post di Marzo 2011)

....Prendiamo il taccuino e facciamo due calcoli spannometrici, molto spannometrici ma che ci permettono di capire:E dal Blog Economic Collapse (anche se sono un tantino pessimisti a senso unico....come avrete potuto intuire dal titolo...)

considerando che ogni +10$ di crescita del prezzo del Petrolio fanno -0,25% di PIL USA e -50 miliardi di $ di Consumi americani... applicate queste formulette petrolifere ai PIIGS e poi fatemi sapere cosa vi è venuto fuori...;-)

In certi Paesi ogni +10$ di aumento del Barile di Petrolio

secondo me potrebbe sottrarre anche -0,5% -0,75% di PIL....

ma dipende anche dagli approvigionamenti oltre che dal prezzo.

.....................

Inoltre in USA ogni 10$ di aumento del Petrolio si traduce in (più o meno) +25cent di costo della benzina al gallone e spannometricamente per 1 cent di aumento della benzina si perde in USA 1 miliardo di $ di consumi

(NdR su dati di Marzo 2011)....visto che la benza è schizzata a 3,5$ al gallone aumentando di 1 dollaro in 12 mesi e di 0,5$ negli ultimi pochi mesi...ci sono già in ballo 50miliardi di $ di consumi in meno....

.... ma sono calcoli spannometri perchè il caro-benzina CAMBIA le abitudini dei consumatori, gli spostamenti, i trasporti merce, la propensione al risparmio, la fiducia consumatori, l'atteggiamento della banca centrale e del governo...

vi riporto la sintesi di un interessante post che analizza cause/effetti/tendenze del caro-petrolio in USA:

The Price Of Gas Is Outrageous – And It Is Going To Go Even Higher............

The price of gas is going even higher even though energy consumption is sharply declining in the United States.

Just check out the charts in this article by Charles Hugh Smith. Americans are using less gasoline and less energy and yet the price of gas continues to go up.

That is not a good sign.

Certainly any decrease that we are seeing in the U.S. is being more than offset by rising demand in places such as China and India.

As emerging economies all over the globe continue to develop this is going to continue to put pressure on gas prices.

So just how bad are gas prices in the U.S. right now?

Just consider the following facts....

-The average price of a gallon of gasoline in the United States is now $3.53.

-The average price of a gallon of gasoline is already higher than $3.70 in Connecticut, Washington D.C. and New York.

-In California, the average price of a gallon of gasoline is $3.96 and there are quite a few cities where it is now above 4 dollars.

-In mid-January 2009, the average price of a gallon of gasoline in the United States was just $1.85.

-The average price of a gallon of gasoline in the United States has risen 25 cents since the beginning of 2012.

-Never before in U.S. history has the price of gasoline been this high so early in the year.

-The Oil Price Information Service is projecting that the price of gas could reach an average of $4.25 a gallon by the end of April.

-The price of oil just keeps going up. The price for West Texas Intermediate is about 19 percent higher than it was one year ago.

-The price of gasoline is also reaching record highs in many areas of Europe as well. For example, the price of diesel fuel in the UK recently set a brand new record.

-In 2011, U.S. households spent a whopping 8.4% of their incomes on gasoline. That percentage has approximately doubled over the past ten years.

.....

Unfortunately, a couple of new bills in Congress right now would reportedly allow even more highways to be made into toll roads.

America used to be the land of the open road, but that era is rapidly coming to an end.Another thing that could put upward pressure on the price of gas is the situation in the Middle East.

Iran has already stopped selling oil to companies in the UK and France, and there is the potential that war could erupt in the Middle East at any time....

........

Well, there is one thing that would likely bring down the price of gas substantially.

A global recession.

Remember what happened back in 2008.

Just like we are seeing right now, the price of gas really spiked early in that year.

Eventually, the price of oil hit an all-time record of $147 a barrel in mid-2008.

But then the financial crisis struck and the price of oil fell like a rock as you can see from the chart below.....

....

There are a ton of other parallels between 2008 and 2012.

In both years, we saw global shipping start to slow down dramatically.

In both years, the U.S. was getting ready to hold a presidential election.

In both years, many economists were warning that a great financial crisis was about to strike.

Back in 2008, the epicenter of the financial crisis was on Wall Street.

This time, the epicenter of the financial crisis will probably be in Europe.

......

So yes, if we see another major global recession that will be great news for the price of gas, but it will be really bad news for the millions of people that lose their jobs and their homes.

Unfortunately, we live at a time when the world is becoming extremely unstable.

The great era of peace and prosperity that we have been enjoying is coming to an end......